Let’s face it—layoffs in US banks have been making headlines left and right lately. From big-name institutions to smaller regional players, the financial world is feeling the heat. If you're wondering why this is happening, how it affects workers, and what it means for the economy, buckle up because we’re diving deep into the details. This isn’t just about numbers; it’s about real people, real jobs, and a shifting landscape that impacts us all.

Imagine walking into your office one day, ready to tackle another day of spreadsheets and client calls, only to find out that your position has been eliminated. That’s the reality for thousands of banking employees across the United States. The wave of layoffs sweeping through US banks isn’t just a blip on the radar—it’s a seismic shift driven by economic pressures, technological advancements, and changing consumer behavior. But what’s really going on behind the scenes?

As we unpack the reasons, implications, and potential solutions, you’ll get a front-row seat to understanding the complexities of this issue. Whether you’re an industry insider, someone affected by these layoffs, or just curious about what’s happening in the world of finance, this article will give you the insights you need to navigate the storm.

Read also:Discover The Magic Behind The Happy Days Cast A Journey Through Time

Why Are US Banks Cutting Jobs?

Alright, let’s cut to the chase. Why are layoffs happening in US banks right now? The answer isn’t as simple as “times are tough.” Sure, economic uncertainty plays a role, but there’s more to it than that. Banks are under pressure from multiple angles—regulatory demands, rising interest rates, and yes, even the rise of digital banking. Let’s break it down:

- Economic Downturn: With inflation still hovering at uncomfortable levels and concerns over a potential recession, banks are tightening their belts. They’re cutting costs wherever they can, and unfortunately, that often means cutting jobs.

- Digital Transformation: Technology is reshaping the banking industry faster than ever. Automation, AI, and online platforms mean fewer tellers, fewer loan officers, and fewer middlemen. If a machine can do the job faster and cheaper, guess who loses out?

- Changing Consumer Preferences: People are banking differently now. Fewer visits to physical branches mean less demand for traditional banking roles. Why hire someone to handle deposits when most customers do it through their phones?

It’s not just about numbers—it’s about adapting to a new reality. And while some might argue that layoffs are necessary for long-term growth, others see it as a sign of deeper issues within the industry.

Top Reasons for Layoffs in US Banks

Here’s a quick rundown of the top drivers behind the current wave of layoffs:

- Cost-cutting measures driven by economic uncertainty

- Investment in technology over human resources

- Shift towards digital-first banking models

- Regulatory compliance costs eating into profit margins

These factors don’t exist in a vacuum. They’re interconnected, creating a perfect storm that’s forcing banks to make tough decisions. But what does this mean for the people caught in the middle?

Impact on Employees: The Human Side of Layoffs

Let’s talk about the people behind the headlines. For every layoff announcement, there’s a worker whose life is turned upside down. Losing a job is never easy, but when it happens in an industry as competitive as banking, the stakes are even higher. Here’s how layoffs are affecting employees:

First off, there’s the immediate financial impact. Many bank employees rely on their steady paychecks to cover everything from mortgages to kids’ college funds. When those paychecks stop coming, it creates a ripple effect that can take months—or even years—to recover from.

Read also:Get The Scoop On Sean William Scotts Present Life An Informal Dive Into His World

Then there’s the emotional toll. Being laid off can be a blow to one’s self-esteem and confidence. It’s not just about losing a job; it’s about feeling undervalued or replaceable. And in an industry where relationships and networks matter, being on the outside looking in can be tough.

Support Systems for Laid-Off Workers

But here’s the thing—not all hope is lost. Many banks offer severance packages, outplacement services, and career counseling to help laid-off workers transition. Some even provide training programs to help employees develop new skills for the digital age.

Here are a few examples of what banks are doing to support their workforce:

- Severance pay ranging from a few weeks to several months of salary

- Access to career coaching and job placement services

- Training programs focused on tech skills like data analysis and coding

Of course, the effectiveness of these programs varies from bank to bank. Some critics argue that they’re not doing enough to address the root causes of layoffs or support workers in meaningful ways.

How Layoffs Affect the Banking Industry

Now let’s zoom out and look at the bigger picture. How do layoffs in US banks affect the industry as a whole? The short answer is: significantly. When banks start cutting jobs, it sends shockwaves through the entire financial ecosystem. Here’s why:

For starters, layoffs can lead to a brain drain. Talented professionals who leave the industry may not come back, taking their expertise with them. This can have long-term consequences for innovation and customer service. Plus, when banks lose key employees, it can affect their ability to serve clients effectively.

Then there’s the reputational damage. Layoffs often make headlines, and not in a good way. Customers may lose trust in institutions they perceive as prioritizing profits over people. And in an era where trust is already fragile, that’s a risk no bank can afford to take lightly.

Long-Term Consequences of Layoffs

So, what’s the long game here? Are layoffs a temporary blip, or are they part of a larger trend? Many experts believe it’s the latter. As banks continue to invest in technology and adapt to changing market conditions, the demand for traditional banking roles will likely decrease. Here’s what that could mean:

- A shift toward more tech-focused job opportunities

- Increased competition for remaining roles in the industry

- Potential for new business models to emerge

While this might sound daunting, it also presents opportunities for growth and innovation. Banks that can successfully navigate this transition may come out stronger on the other side.

Consumer Perspective: What Does This Mean for You?

Alright, let’s flip the script. How do layoffs in US banks affect you as a consumer? Well, it depends on how you interact with the banking system. If you’re someone who prefers online banking, you might not notice much of a difference. But if you’re a fan of face-to-face interactions, things could feel a bit different.

With fewer employees in branch locations, wait times may increase, and the level of personalized service may decline. That’s not to say that all customer experiences will suffer—many banks are investing heavily in digital tools to enhance the user experience. But there’s no denying that the human touch is becoming less common.

Adapting to a New Normal

So, how can consumers adapt to these changes? Here are a few tips:

- Embrace digital banking tools and apps to streamline your financial life

- Stay informed about industry trends and be prepared for changes in service

- Build strong relationships with key contacts at your bank to ensure continuity

By staying proactive and open-minded, you can navigate the evolving banking landscape with confidence.

Historical Context: A Look Back at Bank Layoffs

To truly understand the current wave of layoffs, it helps to look at history. Have we been here before? Yes, and no. While layoffs in the banking sector aren’t a new phenomenon, the scale and scope of today’s cuts are unique. Here’s a quick trip down memory lane:

Back in the 2008 financial crisis, banks were cutting jobs left and right. But those layoffs were driven by a different set of circumstances—namely, a global economic meltdown. Today’s layoffs, on the other hand, are more about structural changes within the industry itself. Think of it as a natural evolution rather than a crisis-induced reaction.

That said, history does offer some lessons. For one, it shows us that layoffs are often followed by periods of innovation and growth. As painful as they may be, they can also be catalysts for positive change.

Learning from the Past

So, what can we learn from previous rounds of layoffs? A few key takeaways:

- Adaptability is key—both for employees and employers

- Investing in technology and training pays off in the long run

- Communication and transparency are essential during times of change

By applying these lessons, banks can minimize the negative impacts of layoffs and set themselves up for success in the future.

Data and Statistics: The Numbers Behind the Layoffs

Let’s talk numbers. How big is the problem, really? According to recent reports, thousands of banking jobs have been eliminated across the US in the past year alone. And the trend shows no signs of slowing down. Here are a few stats to put things into perspective:

- Over 20,000 banking jobs were cut in 2022, according to industry analysts

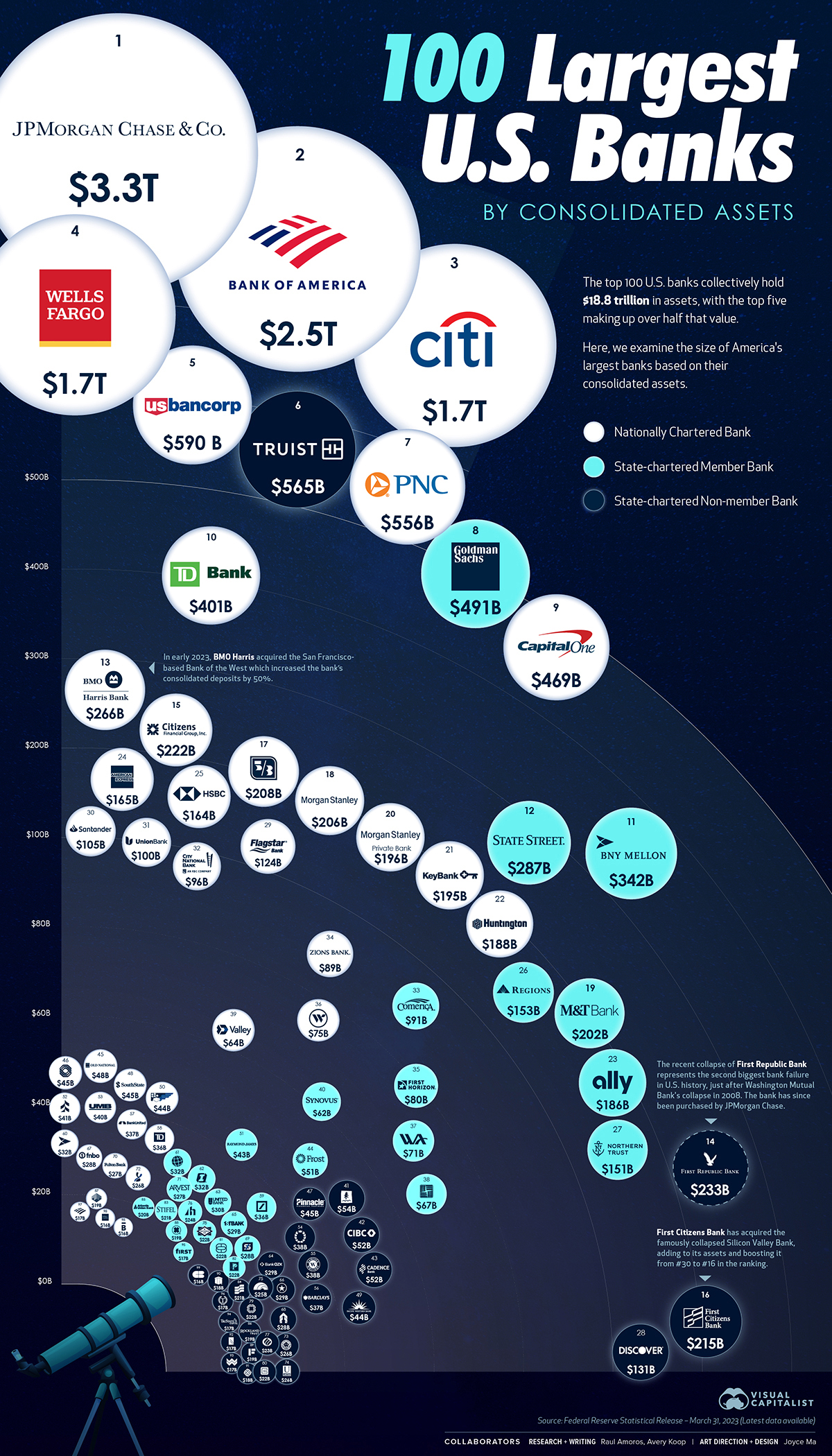

- Major banks like JP Morgan Chase and Wells Fargo have announced significant layoffs in recent months

- Regional banks are also feeling the pinch, with some reporting double-digit percentage cuts

These numbers are sobering, but they also highlight the scale of the challenge facing the industry. By understanding the data, we can better grasp the scope of the issue and identify potential solutions.

What the Numbers Tell Us

So, what do these statistics mean for the future of banking? A few things:

- Job security in the banking sector is becoming increasingly uncertain

- Investment in technology and automation is accelerating

- There’s a growing need for reskilling and upskilling in the workforce

While the numbers can be daunting, they also offer a roadmap for navigating the changes ahead.

Future Outlook: Where Do We Go From Here?

As we wrap up this deep dive into layoffs in US banks, let’s take a moment to look ahead. What does the future hold for the banking industry, and how can we prepare for it? Here’s what experts are saying:

First off, expect more of the same. Layoffs are likely to continue as banks seek to streamline operations and embrace new technologies. But there’s also reason for optimism. As the industry evolves, new opportunities will emerge—both for workers and consumers.

For employees, this means staying adaptable and continuously developing new skills. For consumers, it means embracing digital tools and staying informed about industry trends. By working together, we can ensure a smoother transition to the banking landscape of tomorrow.

Your Call to Action

So, what can you do right now? Here are a few suggestions:

- Stay informed about layoffs and industry trends by following reliable news sources

- Invest in your own skill development, especially in areas like tech and data analysis

- Engage with your bank to understand how changes may impact your experience

Together, we can navigate the challenges ahead and build a brighter future for everyone involved.

Conclusion: The Road Ahead

As we’ve explored in this article, layoffs in US banks are a complex issue with far-reaching implications. From the economic pressures driving the cuts to the human stories behind the headlines, there’s a lot to unpack. But one thing is clear: change is inevitable, and how we respond to it will shape the future of the banking industry.

So, what’s next? For workers, it’s about staying resilient and adaptable. For consumers, it’s about staying informed and proactive. And for banks, it’s about balancing innovation with compassion. By working together, we can create a banking system that works for everyone.

Now it’s your turn. What are your thoughts on layoffs in US banks? Share your insights in the comments below, and don’t forget to check out our other articles for more insights into the world of finance. Let’s keep the conversation going!

Table of Contents